nassau county tax grievance application

To apply to STAR a new applicant must. E-sign Nassau County Tax Grievance Application Suffolk County Tax Grievance.

How Property Tax Grievance Works Aventine Properties

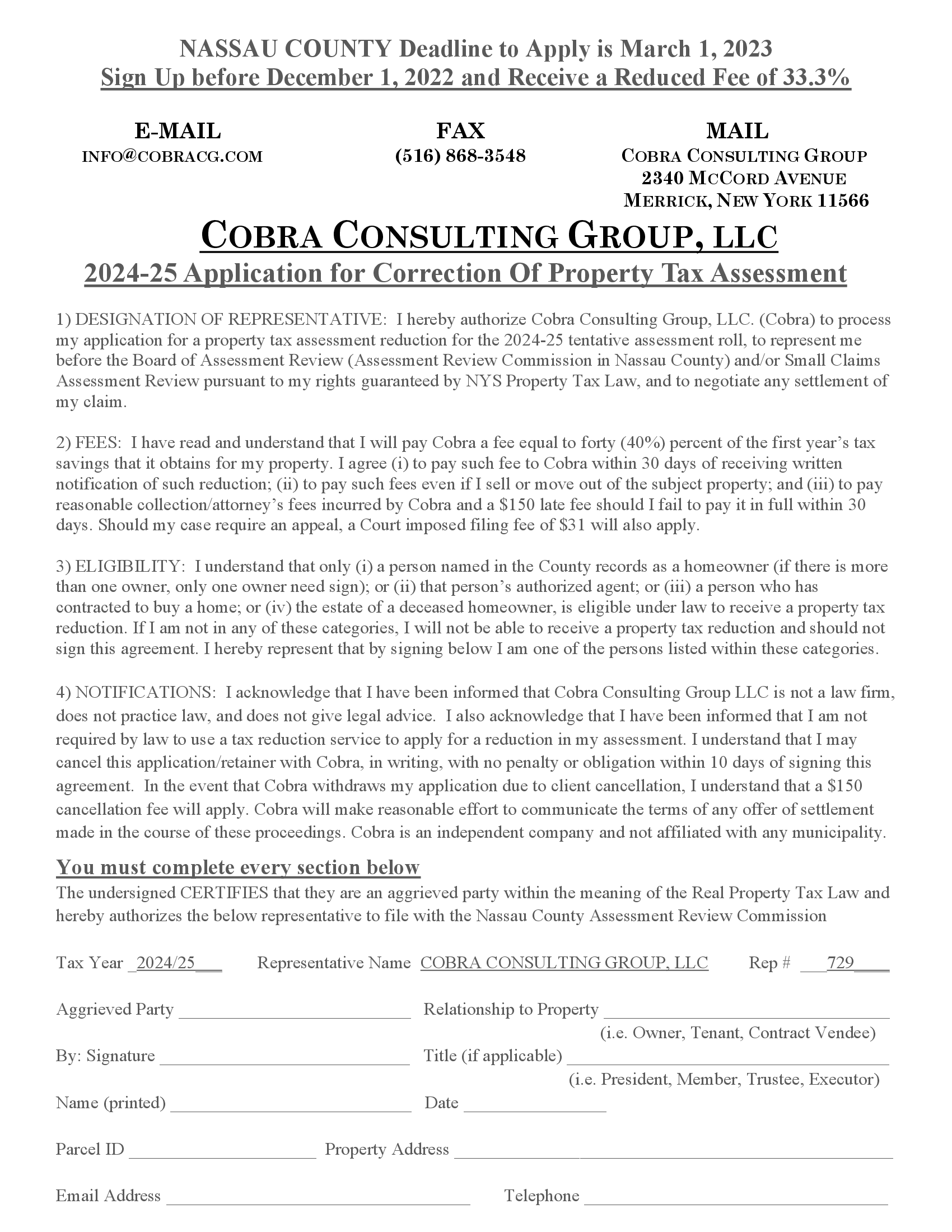

Nassau County Assessment Review Commission.

. Click Here to Apply for Nassau Tax Grievance. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Nassau County Department of Assessment offers a property tax appeal process.

I Agree to Pay Nothing Unless My Taxes Are Reduced. Submitting an online application is the easiest and fastest way. In exchange for property tax grievance services I the owner contract vendee or authorized agent agree to pay Heller.

Use Form RP-425 Application for School Tax Relief STAR Exemption available on the Tax Departments website at tax. I the undersigned hereby certify that I am the owner of the listed property. Dont Let the IRS Intimidate You.

Completing the grievance form Properties outside New York City and Nassau County. Over 450000 Nassau County homeowners filed a tax grievance over the past two years. Nassau County Property Tax Grievance Application DEADLINE.

You Dont Have to Face the IRS Alone. Many grievance services seek an. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

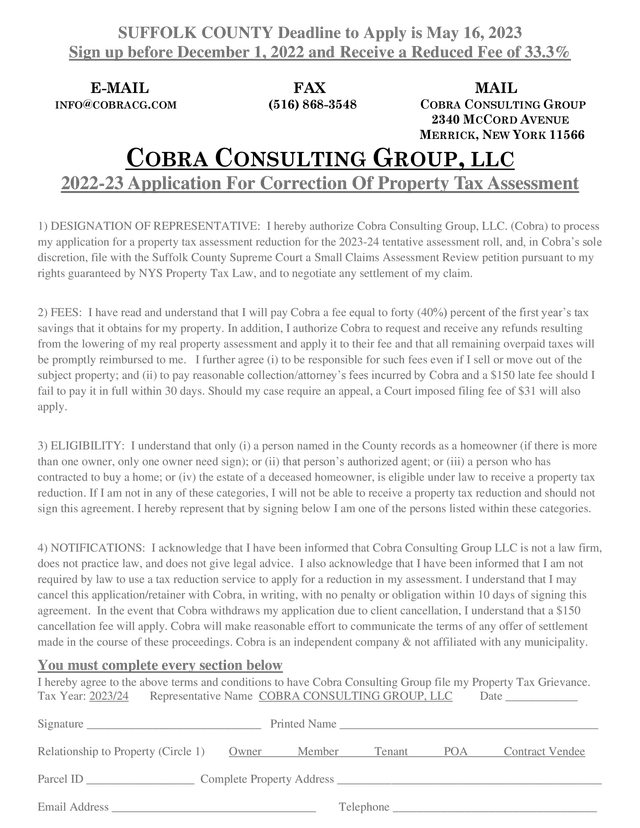

Outside of New York City and Nassau County use Form RP-524 Complaint on. Complete Edit or Print Tax Forms Instantly. In an Application for Correction of Property Tax Assessment.

When your neighbors apply and get successful reductions some of that cost is passed on to you. New York City residents. Between January 3 2022 and March 1 2022 you may appeal online.

A person named on the property deed of the County Clerks office as the homeowner. AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit. Click Here to Apply for Nassau Tax Grievance.

Ad Apply For Tax Forgiveness and get help through the process. Click this link if you. Nygov or contact the.

The first step in the process is to file an affidavit with your county assessors office within six months. Ways to Apply for Tax Grievance in Nassau County. Use one of ARCs three application forms.

Superior Property Tax Grievance Pro Se Consultation Service with 20 years of home valuation experience and over 10 years specializing in property tax grievances. New York City Tax Commission. 75443yr - Brookville Rd Brookville.

Ad Download Or Email Form RP-524 More Fillable Forms Try for Free Now. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes. Ad 5 Best Tax Relief Companies of 2022.

AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Use one of ARCs three application forms.

And Expense to the Nassau County Department of Assessment by April 1. Ad Access Tax Forms. Appeal your property taxes.

MARCH 1 2023 Eligibility. Get the Help You Need from Top Tax Relief Companies. How It Works The TRS Process.

However the property you entered is. Click to request a tax grievance authorization form now. Deadline for filing Form RP-524.

Pay Just 50 of 1st Years Savings Tax Grievance Applications Click on the County Name to Apply Online NOW. You may file an online appeal for any type of property including commercial property and any type of claim. End Your Tax Nightmare Now.

The Nassau County filing deadline has passed to grieve your. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Apply For Property Tax Grievance Zap My Tax

Suffolk County Tax Grievance Form

59 Ridge Road Searingtown Ny 11507 Mls 3195808 Rockethomes

Free Property Tax Assessment Grievance Workshop Mid Island Times

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

News Flash Nassau County Ny Civicengage

News Flash Nassau County Ny Civicengage

Nassau County New York Grievance Period Extended

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Tax Grievance Property Tax Reduction Long Island

Property Tax Grievance The Heller Clausen Grievance Group Llc Homepage Property Tax Grievance The Heller Clausen Grievance Group Llc

Nassau County Tax Grievance Form

Nassau County Grants Tax Grievance Extension Long Island Weekly